GRANDMA Wants Digital Banking Too

“How might we support older users to feel confident with the digital banking experience as they transition away from traditional banking methods?

As I worked as a banking professional, I witnessed the industry shifted from traditional teller services to expanded digitalization. At my current job, where banking requests are now exclusively handled online, I’ve observed how older users often struggle with navigating these portals.

This sparked a critical question for me: why aren’t technological advancements more inclusive and accessible to all users? Inspired to address this gap, I started this project “myPluto” from ideation to end-to-end design.

As banking becomes increasingly digitized such as AI and Automation, reaching underserved markets such as senior users becomes a significant challenge.

My expertise in understanding specific market needs, cultivating relationships, and educating the underserved markets will ensure the success of this UX project. This will result in expanding outreach, promoting financial inclusion, and achieving business goals.

MY ROLE

User Research

User Interviews

Journey Mapping

Sketching

Wireframing

Screen Flows

Visual Design

Interaction Design

PLATFORMS

iOS

YEAR

2024

Initial Problem Discovery

(What problem am I trying to solve?)

Elderly individuals struggle with daily banking tasks due to limited digital skills, complex interfaces, and privacy worries.

The COVID-19 pandemic has swiftly driven the adoption of digital ecosystems, compelling businesses and consumers alike to rely heavily on online platforms for everyday activities, leaving tech-shy elderly individuals financially isolated.

Many older adults, who may struggle with navigating digital tools or fear the complexities and perceived risks of technology, find themselves excluded from essential financial services and interactions.

Initial Research/Problem Validation

(What does current banking landscape look like?)

The rise of digital banking trends, such as mobile apps and online services, aligns seamlessly with banks' strategies to lower operational costs and boost revenue streams.

Digital channels accounted for 61% of US Bank’s total loan sales in the three months ending February 2021, a jump from 39% a year earlier.”

Only 15.3% of aged 65 or older of users reported using mobile banking primarily, compare to 69.4% of Generation Z.”

“While the financial industry has been closing branches for years, the pace accelerated sharply in 2021 after the Covid-19 pandemic in the adoption of mobile and online banking. That year, banks closed nearly 18% of their in-store branches and 3.1% of other locations.”

— CNBC

The COVID-19 pandemic has accelerated the trend of digital banking, leading many customers, especially senior customers who are unfamiliar with online banking, to adopt mobile banking for the first time.

Older Americans are worried about financial loss due to online banking fraud — Adults 60 and older were victims of financial fraud estimates over 3.5 million in 2017.”

Understanding Target Audience

(Whose problem am I solving?)

Traditional Banking Enthusiast

Prefers face-to-face interactions at the bank branch.

Limited tech proficiency, open to a gradual transition.

Maybe resistant to change, requiring a user-friendly interfaces to ease the shift.

Reluctant to Try New Technologies

Limited exposure to technology, comfortable with basic phone functions.

Only performs tasks that routinely done, such as checking balances and withdrawing money.

Prefers simple and familiar interfaces to avoid confusion.

Traumatized by Past Digital Banking

Experienced a fraud incident with digital banking platform.

Strong apprehension toward digital transactions; requires reassurance and education on enhanced security features.

Prioritizes clear communication about security measures to rebuild trust.

Research & Explanation

(What methods of UX research I use to clarify and focus to my solution, and why?)

UX Research Method 01: Competitor’s Analysis

While competitors focus on tailoring banking features and security measures to suit their user demographics, they struggle to adequately address the specific banking needs of older users.

Primarily Apple users, such as affluent millennials and Gen Z.

Offering a seamless and user-friendly experience across all Apple devices.

Apple Pay does not target users who are unfamiliar with Apple Devices, including senior or new users. Such as the ‘Transfer’ function is only exclusively available to Apple device users.

UX Research Method 02: User Surveys

46%

Reserved stance regarding mobile/online banking

46% of participants expressed a preference for maintaining their current financial management methods and do not consider utilizing online banking.

Creating a small network among friends and family like a social media account for money.

Adding fun and interaction with emojis and comments.

Making money conversations enjoyable, usually tricky among close friends.

Venmo has privacy and security concerns and higher adoption rate by younger generations.

I conducted a survey involving 15 individuals aged 50+ to gather insights into their existing banking practices and openness to adopting mobile/online banking.

I gathered feedback from both users familiar and unfamiliar with mobile/online banking. This helped me understand their attitudes, opinions, pain points, and levels of trusts towards using mobile/online banking.

Obtaining quantitative data validates my initial problem discovery, showing that I am in the right direction based on the survey insights.

67%

Concerns for security

67% of participants are concerned

security and the potential breach of their personal information if they use mobile/online banking.

UX Research Method 03: User Interviews

91% of participants still visit

a branch with tellers for assistance with their banking transactions.

To enhance our understanding of users, I conducted in-depth interviews with three participants, building upon the insights from the survey results.

After analyzation, I created journey map to see the tendency of users categorised into Managing finances, Security, Attitudes, Wishes and Concerns.

Then I could analyse into three groups, which can be categorized as below.

Hesitancy to start mobile/online banking

Users persist in the perception that digital banking is a recent innovation tailored for advanced technology devices. They feel hesitant and struggle to start without assistance.

91%

Continuing to visit branches

and tellers

Fears surrounding security and fraud

Users persist in the perception that digital banking is a recent innovation tailored for advanced technology devices. They feel hesitant and struggle to start without assistance.

Lack of notifications and reminders

Users frequently overlook or avert issues related to fraud, which encompass neglecting timely reminders to monitor expenses and identify potential fraudulent activities.

Research takeaways

Low digital literacy hinders seniors people’s confidence in achieving goals with technology, serving as a barrier to mobile/online banking adoption.

Concerns and fear of making mistakes or misunderstandings lead to financial loss through an accident or fraud.

Hypothesis Statement

(So What?)

If I develop a mobile banking application tailored to senior users, addressing concerns and ensuring ease of use in mobile banking, it empowers them to confidently navigate their finances in the evolving digital landscape of the banking industry.

The current mobile/online banking services lack active efforts to adequately educate seniors about distinguishing between scams and legitimate transactions.

Problem/Opportunity Spaces

(How am I going to address the problem spaces in my designs?)

Problem Space # 1

Low digital literacy hinders senior people’s confidence in achieving goals with technology, serving as a barrier to mobile/online banking adoption.

Problem Space # 2

The users concern regarding the possibility of making transactional mistakes or experiencing misunderstandings. These concerns could potentially result in financial losses, especially within the context of fraudulent activities.

Problem Space # 3

The current mobile/online banking services lack of active efforts in adequately educate seniors to distinguish between scams and legitimate transactions.

Creating clean and simple UI, similar Scandinavian design in mobile banking.

Incorporating inclusive messaging by portraying seniors using mobile banking to influence other seniors, positively empowering them as positive role models so they can see themselves using online banking.

Designing a user experience that seamlessly integrates daily routines, akin to a habitual activity, while navigating mobile banking. This includes features like setting savings goals and monitoring progress.

Providing transparent information and explanations during onboarding and when requesting personal details—clarifying the purpose and usage of the personal information.

Establishing straight forward banking security through clear messaging and user-friendly interface design

incorporating an additional warning screen or password screen before any financial transaction to proactively educate senior users about scams and fraud before the transaction occurs.

Providing real time alerts regarding all transactions and let the users flag any activity they authorize and not.

The Solution

Creating a user-friendly mobile application for seniors to easily access mobile banking, eliminating the feeling of isolation and boosting confidence in mobile banking engagement.

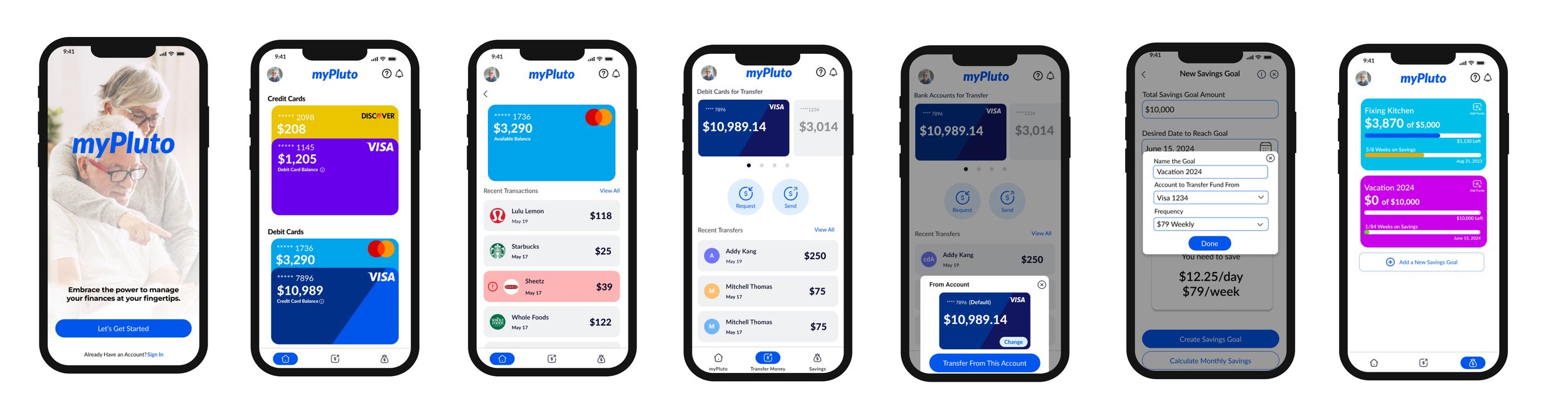

Prototypes

(How do I want to apply this solution into first draft of the app?)

I began with low-fidelity prototypes to translate the design concept into a tangible product. By quickly sketching the ideas, I ensured the process was fast and easy to iterate. My design approach focused on simplicity and delivering a clear, simple accessible message on each screen tailored to seniors.

As I work through, there were several iterations on steps, refining the process to enhance clarity, efficiency, and user experience, ensuring that each adjustment brought measurable improvements.

Feedback & Revisions from other UX Designers

myPluto Wallet

Implementing an extra layer of advanced security features to enhance the overall protection

Users are flagged and prompted to verify or indicate if they don't recognize suspicious transactions, enabling real-time monitoring of transactions in the app.

Transfer with Confidence and Security

Adding extra verification before financial transactions to educate seniors on scams and fraud.

Educate the users before the transactions by giving an examples of common scams.

Money Milestone Tracker

Users can actively engage in the establishment of savings goals, defining clear objectives for their financial aspirations. They can monitor and track their progress systematically, ensuring a transparent and motivating approach towards achieving their set savings goals.

Creating habit-forming user experiences that effortlessly blend into daily routines using myPluto mobile app banking